The Ultimate Guide to Accounting Software Solutions: Streamlining Financial Management

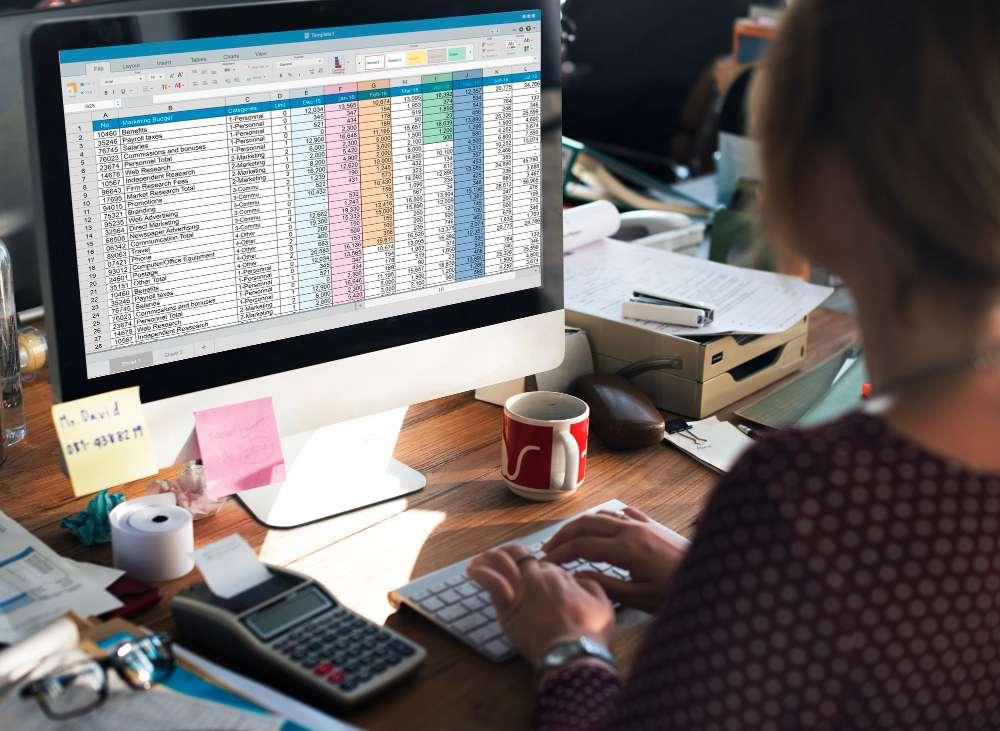

Accounting is an essential aspect of any business, and the right accounting software can make all the difference. However, with so many options available in the market, choosing one that best suits your business needs can be overwhelming. You may find yourself struggling to choose the right accounting software for your business, but worry not, we have got you covered. In this post, we will help you navigate through this process, and make an informed decision. So, let's begin.

Here are some important steps to consider when choosing the right accounting software:

Define your business needs: Identify your accounting requirements, desired features, automation level, and scalability for effective software selection.

Consider integrations and add-ons: Ensure the software is compatible with your existing systems and explore add-ons that enhance functionality.

Evaluate user-friendliness: Choose user-friendly software with intuitive interfaces, tutorials, and reliable customer support.

Check compliance and regulations: Ensure the software meets industry-specific compliance and regulation requirements.

Determine your budget: Assess the cost, features, and support offered by different software options to find the best fit for your budget.

Let’s take a look at some of the trending software's in the market and the benefits they offer.

1. Nextzen Limited

Nextzen Limited is one of the most popular accounting software among small businesses. It offers a user-friendly interface and is a cost-effective solution. Some of its features include:

• Integration with banks and credit cards

• Easy invoice creation

• Automatic payment reminders

• Bill tracking

• Payroll services

2. Xero

Xero is another cloud-based accounting software that has gained a lot of popularity in recent years. Here are some of the benefits it offers:

• Easy bank reconciliation

• Wide range of add-ons available

• Dashboard with all the essential information

• Simple user interface

• Multi-currency support

3. Zoho Books

If you are looking for an all-in-one accounting software, Zoho Books may be the perfect solution for you. It includes features such as:

• Inventory management

• Purchase order creation

• Project management

• Invoicing and billing

• Budgeting and forecasting

4. Wave

Wave is a free accounting software that offers essential features that are perfect for freelancers and small businesses. Some of these include:

• Invoicing and billing

• Accounting reports

• Receipt scanning and organization

• Credit card and bank integration

• Payroll services (at an additional cost)

5. FreshBooks

FreshBooks is a cloud-based accounting software that offers user-friendly features and easy integration. Here are some of the benefits you can expect:

• Invoicing and payment processing

• Time tracking

• Expense tracking and organization

• Automatic payment reminders

• Project management

Choosing the right accounting software is essential for businesses to thrive, and at VASL, we've gained a competitive edge and satisfied our clients by utilizing Nextzen Limited and Xero. These industry-leading platforms have empowered us to streamline financial operations, provide real-time insights, and optimize collaboration. Our clients appreciate the efficiency and accuracy we deliver, making informed decisions based on comprehensive financial data. By investing in the right accounting software, we have elevated our business and ensured long-term success. In this post, we have discussed some of the trending accounting software in the market, including Nextzen Limited, Xero, Zoho Books, Wave, and FreshBooks.

Introduction:

Effective financial management is essential for businesses of all sizes in the modern digital era. Accounting software solutions simplify financial administration by giving users the means to manage activities including payroll, spending monitoring, invoicing, and reporting. However selecting the best accounting software might be difficult due to the abundance of options on the market. We'll go over the main characteristics, advantages, and factors to take into account when choosing the ideal accounting software for your company's requirements in this extensive guide.

-

Understanding Accounting Software:

- Definition and Purpose: What is accounting software, and why is it essential for businesses?

- Types of Accounting Software: Explore categories such as cloud-based, desktop, and hybrid solutions.

- Key Features: Overview of common features including invoicing, expense tracking, financial reporting, and integration capabilities.

-

Benefits of Using Accounting Software:

- Time Efficiency: How accounting software automates repetitive tasks, saving time for business owners and finance professionals.

- Accuracy and Error Reduction: Discuss how automated calculations minimize human errors and ensure accurate financial records.

- Financial Visibility: Highlight the importance of real-time insights into cash flow, profit margins, and overall financial health.

-

Choosing the Right Accounting Software:

- Assessing Business Needs: Identify your specific requirements and challenges to narrow down software options.

- Scalability: Consider future growth and whether the software can accommodate the evolving needs of your business.

- Budget and Affordability: Evaluate pricing plans, including subscription-based models, and compare features versus costs.

- User-Friendliness: User interface and ease of use are critical factors for adoption and employee productivity.

-

Top Accounting Software Solutions:

- QuickBooks: Overview of QuickBooks Online and QuickBooks Desktop, highlighting their robust features and popularity among small to medium-sized businesses.

- Xero: Explore the cloud-based accounting software known for its accessibility, intuitive interface, and extensive integrations.

- FreshBooks: Discuss FreshBooks' user-friendly platform, designed for freelancers and small service-based businesses, with features like time tracking and client management.

- Sage Intacct: Targeted toward mid-sized and enterprise-level businesses, Sage Intacct offers advanced financial management capabilities and customizable reporting.

-

Implementation and Training:

- Onboarding Process: Tips for a smooth transition, including data migration, software setup, and initial training for users.

- Ongoing Support: Evaluate the availability of customer support, online resources, and community forums for troubleshooting and assistance.

-

Security and Compliance:

- Data Security: Discuss the importance of encryption, data backup, and secure login protocols to protect sensitive financial information.

- Regulatory Compliance: Ensure that the chosen software complies with relevant accounting standards and regulations, such as GAAP or IFRS.

-

Integrations and Add-Ons:

- Enhancing Functionality: Explore integrations with third-party apps and add-ons for additional features such as CRM, inventory management, and project tracking.

- API Accessibility: Assess the availability of APIs for custom integrations and automation workflows tailored to your business processes.

-

Conclusion:

- Recap of key points discussed in the guide, emphasizing the importance of selecting the right accounting software solution to streamline financial management and drive business growth.

- Encourage readers to conduct further research, trial software demos, and consult with industry experts to make informed decisions.

Businesses may confidently traverse the world of accounting software solutions by adhering to this thorough guidance, which will ultimately improve productivity, accuracy, and financial visibility within their enterprises.

Advancing Financial Management: The Compelling Case for Accounting Software Solutions

Introduction:

Success in the digital age depends on keeping strong financial management procedures because every facet of organization is changing quickly. Introducing accounting software solutions, the cutting-edge force that is transforming how companies manage their finances. Accounting software has many advantages that are essential for companies of all sizes, ranging from automating time-consuming operations to offering real-time information. In this blog post, we examine the strong arguments for why businesses aiming for financial excellence should not only use accounting software solutions, but also heavily rely on them.

Enhanced Efficiency and Accuracy:

- Accounting software automates repetitive operations like data input, invoicing, and reconciliation, which simplifies financial processes.

- Accounting software guarantees data quality and integrity by removing human error and inconsistencies present in conventional paper-based systems.

- Businesses can concentrate on strategic financial analysis and decision-making thanks to time-saving features like automated bank feeds and recurring billing.

Real-Time Financial Insights:

- Instant access to current financial data, including as cash flow, profit and loss accounts, and balance sheets, is made possible by accounting software.

- Businesses may make well-informed decisions by gaining actionable insights into financial trends and key performance indicators (KPIs) through configurable dashboards and reporting tools.

- Businesses are better equipped to recognize opportunities, reduce risks, and quickly adjust to shifting market conditions when they have timely access to financial data.

Streamlined Compliance and Reporting:

- Accounting software automates computations and generates accurate reports, making compliance with tax laws, accounting standards, and reporting obligations easier.

- The possibility of non-compliance fines is reduced by built-in features that guarantee conformance to International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

- Regulatory audits and inspections are made easier by the use of audit trails and document management systems, which promote traceability and openness.

Improved Cash Flow Management:

- Businesses may track revenue and expenses in real-time with accounting software, which makes proactive cash flow management and forecasting possible.

- Automated invoicing, receivables tracking, and payment reminders are some of the features that speed up the collection process, cut down on past-due payments, and improve cash flow.

- In order to ensure financial stability and resilience, organizations should prepare for future spending, investments, and growth efforts with the use of budgeting and forecasting tools.

Scalability and Flexibility:

- Accounting software solutions can adapt to the changing needs and growth paths of companies since they are scalable.

- Cloud-based accounting software makes it possible to access financial data from any location at any time using any internet-enabled device, which makes it easier to collaborate and operate remotely.

- Accounting software may be customized to meet the unique needs of businesses thanks to its modular architecture and customizable capabilities, which also enable easy integration with other systems and scalability as the firm grows.

Cost Savings and ROI Maximization:

- Accounting software may seem like a big initial expenditure, but in the long run, the advantages are significantly greater.

- Over time, measurable cost reductions are produced by less administrative overhead, increased productivity, and decreased errors.

- Businesses can find chances for revenue development, cost optimization, and operational efficiency, optimizing return on investment (ROI), with the help of enhanced financial visibility and strategic insights.

Conclusion:

It is now strategic imperative rather than a luxury to leverage accounting software solutions in a competitive business environment marked by rapid digital transformation. Businesses can increase profitability, assure compliance, obtain real-time insights, and optimize financial procedures by implementing accounting software. Purchasing accounting software is a smart move that opens the door to both long-term financial success and sustainable growth, regardless of the size of your company—a small startup or a large multinational.